One of the perks of owning a vehicle for business purposes is the ability to claim deductions on your taxes. The Internal Revenue Service (IRS) provides two primary methods for calculating these deductions: the standard mileage deduction and the actual expenses method. Both options have their advantages and considerations, and understanding the differences between the two can help you make an informed decision. In this blog post, we’ll delve into the disparities between the standard mileage deduction and the actual expenses method, helping you determine which approach is best for your unique situation.

Standard Mileage Deduction:

The standard mileage deduction is a simplified method offered by the IRS. It allows business owners to deduct a predetermined amount for every mile driven for business purposes. The IRS sets the mileage rate each year, taking into account factors such as fuel prices, vehicle maintenance costs, and depreciation. For the tax year 2023, the standard mileage rate is 65.5 cents per mile.

Advantages:

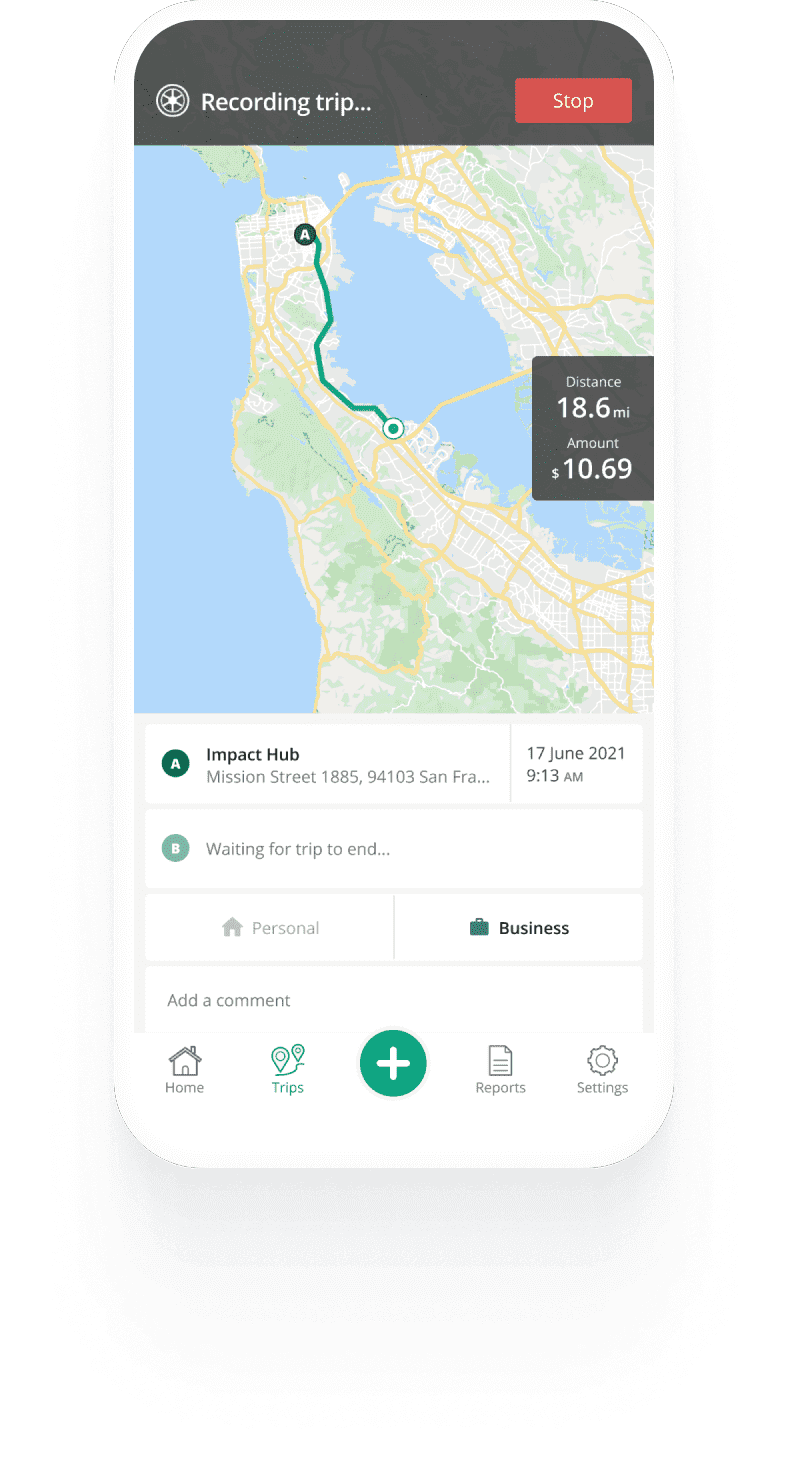

a. Simplicity: Using the standard mileage deduction is straightforward and requires minimal record-keeping. You only need to track your business mileage and total mileage rather than individual expenses.

b. Convenience: Calculating your deduction based on mileage can save you time and effort compared to tracking and documenting each expense.

Considerations:

a. Vehicle Expenses Excluded: When using the standard mileage deduction, you cannot claim any individual vehicle expenses such as fuel, repairs, maintenance, insurance, or depreciation.

b. Lease Restrictions: If you lease your vehicle, you can only use the standard mileage deduction for the first year. Afterward, you must switch to the actual expenses method.

Actual Expenses Method:

The actual expenses method involves deducting the actual costs associated with using your vehicle for business purposes. This approach requires careful record-keeping, as you must document and retain receipts for all expenses related to your vehicle, including fuel, repairs, maintenance, insurance, registration fees, and depreciation.

Advantages:

a. Comprehensive Deductions: With the actual expenses method, you can deduct a wide range of vehicle-related costs, potentially leading to higher deductions.

b. Leasing Flexibility: Unlike the standard mileage deduction, the actual expenses method allows you to claim deductions for leased vehicles beyond the first year.

Considerations:

a. Record-Keeping and Documentation: To maximize your deductions, you need to maintain accurate records of all vehicle-related expenses, which can be time-consuming and require organizational discipline.

b. Depreciation Calculations: Calculating vehicle depreciation accurately can be complex and may require assistance from a tax professional.

Choosing the Right Method:

Deciding whether to use the standard mileage deduction or the actual expenses method depends on various factors, including the number of business miles driven, the type of vehicle, and your record-keeping capabilities. Here are some considerations to keep in mind:

- Mileage Volume: If you drive a significant number of business miles, the standard mileage deduction might result in a higher overall deduction due to the predetermined mileage rate.

- Vehicle Expenses: If your vehicle requires substantial maintenance or repair expenses, or if you have high insurance or depreciation costs, the actual expenses method may lead to a more substantial deduction.

- Record-Keeping Capacity: Consider your ability to maintain meticulous records of all vehicle-related expenses. If you have a well-organized system in place or use dedicated expense-tracking apps, the actual expenses method may be a viable option.

Conclusion:

When it comes to maximizing your business vehicle tax deduction, choosing between the standard mileage deduction and the actual expenses method is a decision that requires careful consideration. The standard mileage deduction provides simplicity and convenience, while the actual expenses method allows for comprehensive deductions but demands meticulous record-keeping. Every situation is different, so if you are interested in more help analyzing options for your business, please let us know!

Disclaimer: The information provided above is not meant to be legal or tax advise. You should consult your CPA and attorney to determine the best course of action for your situation.

Mitzi E. Sullivan, CPA is a cloud based professional services provider

specializing in cloud accounting.